Chicago’s Economy Cannot Afford Another Tax

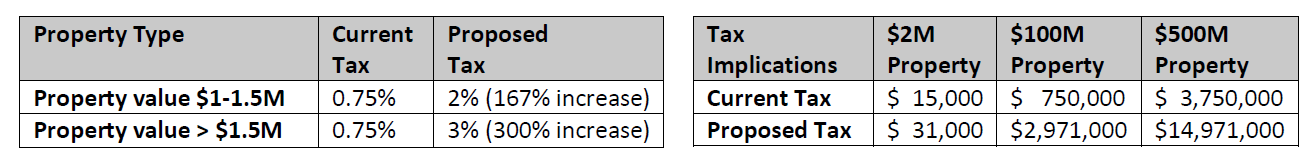

The Bring Chicago Home Proposal Would Quadruple the Real Estate Transfer Tax. The proposed three-tiered

system discourages global investment by increasing transfer taxes on properties valued at $1 million and above.

While transfer tax on properties under $1 million will decrease slightly from .75% to .6%, properties over $1

million will see significant increases in the midst of market turmoil:

- With this increase, Chicago would have one of the highest transfer taxes compared to competitive cities.

- The cities of Atlanta, Austin, Boston, Dallas, Denver, Houston, Indianapolis, Miami, Minneapolis, and Nashville do not assess transfer taxes; 14 states do not assess a transfer tax, including Indiana and Texas.

The Proposed Transfer Tax Increase Hurts Renters, Homeowners, and Local Neighborhoods

- Renters will see rising rents, as costs to purchase housing units are passed down to tenants.

- There are nearly 32,000 properties worth $1M or more in Chicago subject to the transfer tax.

- Many small neighborhood residential buildings with ground level retail are valued at $1M or more.

- An increase will keep grocers, health care facilities, and small businesses out of neighborhoods.

- Many Chicago families pool resources to live in multifamily buildings and may rent out a unit – this tax takes away tens of thousands of dollars from families trying to build wealth.

- Tax increase impedes development and maintenance of affordable and market rate rental apartments.

Record-High Office Vacancies Will Shift Property Tax Burden to Homeowners

- Downtown offices have a record-high vacancy of 22%, with less than half of workers returning.

- Office buildings anticipate 40-80% drops in value, which will increase residential property taxes 10-20%.

- Building transactions and conversions to affordable units will be hampered if transfer taxes increase.

- Tax increase on top of increased commercial property taxes further impedes development, union job creation, and tax base growth for schools, public safety, and more.

The Proposed Tax is a Blank Check—Work with All Stakeholders to Develop a Thoughtful Plan

- This transfer tax increase does not include a real plan to increase housing for the homeless.

- We should understand the effectiveness of current homelessness funding before raising taxes.

- The City’s 2023 budget allocated a substantial $200M toward homelessness programs.

- The City’s 2023 budget also allocated funding for rapid rehousing and affordable housing projects.

- Only 15% of $52M in federal funds for homelessness have been spent.

- All stakeholders should be involved to develop a thoughtful plan to support the unhoused.

For More Information, contact Amy Masters at BOMA/Chicago at amasters@bomachicago.org or 312.870.9612.